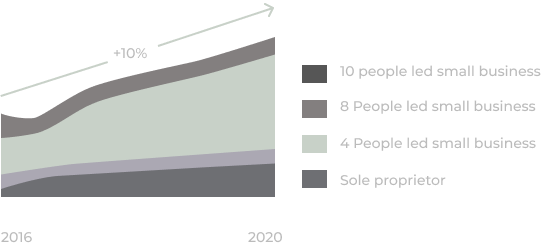

SME Lending is rapidly evolving and will likely move towards Marketplace based lending platforms which provide choice to SME

- SME working capital needs are increasing

- Mass SME led lending demand will drive future growth.

- Platform need to cater to mass market by reducing cost of operations over time

End to end SaaS based Digital Lending Platform for Lending Institutions

Credit Underwriting

Automated AI ML based credit underwriting with RAROC calculation for risk assessment

End to End Digital Lending

Loan origination to loan management with collection in straight through processing. Web and Mobile based omni-channel interaction.

SME Lending Products and Pricing

Multiple products & pricing related to SME lending like bill discounting, working capital mgmt., term loan.

API aggregation and implementation

Aggregation of multiple APIs in the platform for providing seamless experience to financial institution.

Platform driven to drive insights and boost sales

- Sales Portfolio

- Sales Performance

- Customer and Product Insights

- Simulation Tools

- Ecosystem Offers

>

>